Insurers can surely develop a competitive advantage by looking at how leading technology and consumer-product companies accelerate product development and improve customer experience. Our intent here is to support our insurance clients globally in understanding and engaging with their end consumers.

We see how quickly technology is enabling consumers to inform themselves and purchase very differently than how they used to – just a few years back – and we can help you to remain ahead of that curve. By attending this facilitated and hands-on workshop or an online assessment, Life insurance stakeholders can know where they are now, their strengths and oppurti=unities, and where they would like to go.

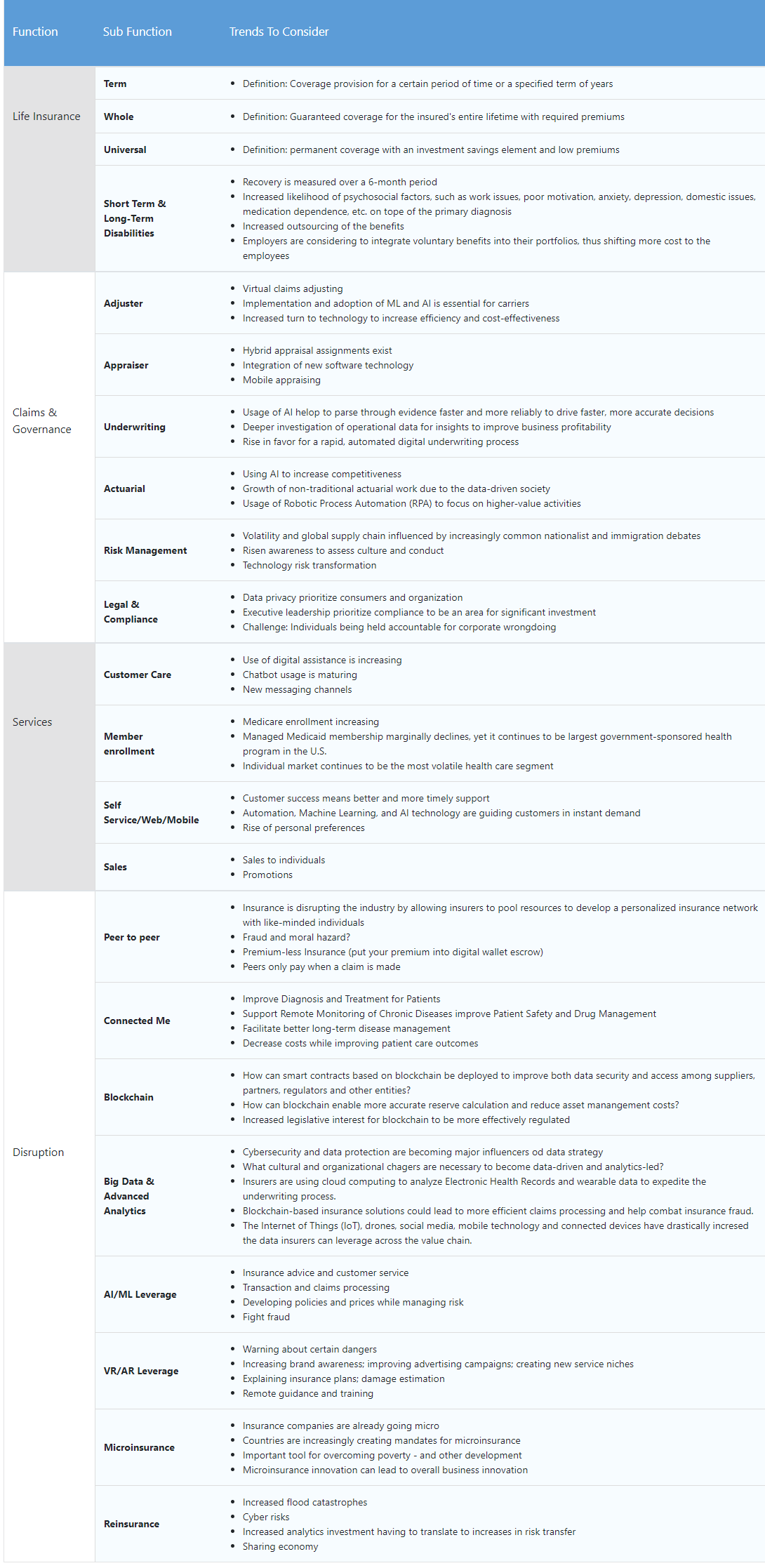

What and how we assess Life Insurance Innovation programs?

How the scores are calculated by our assessment?

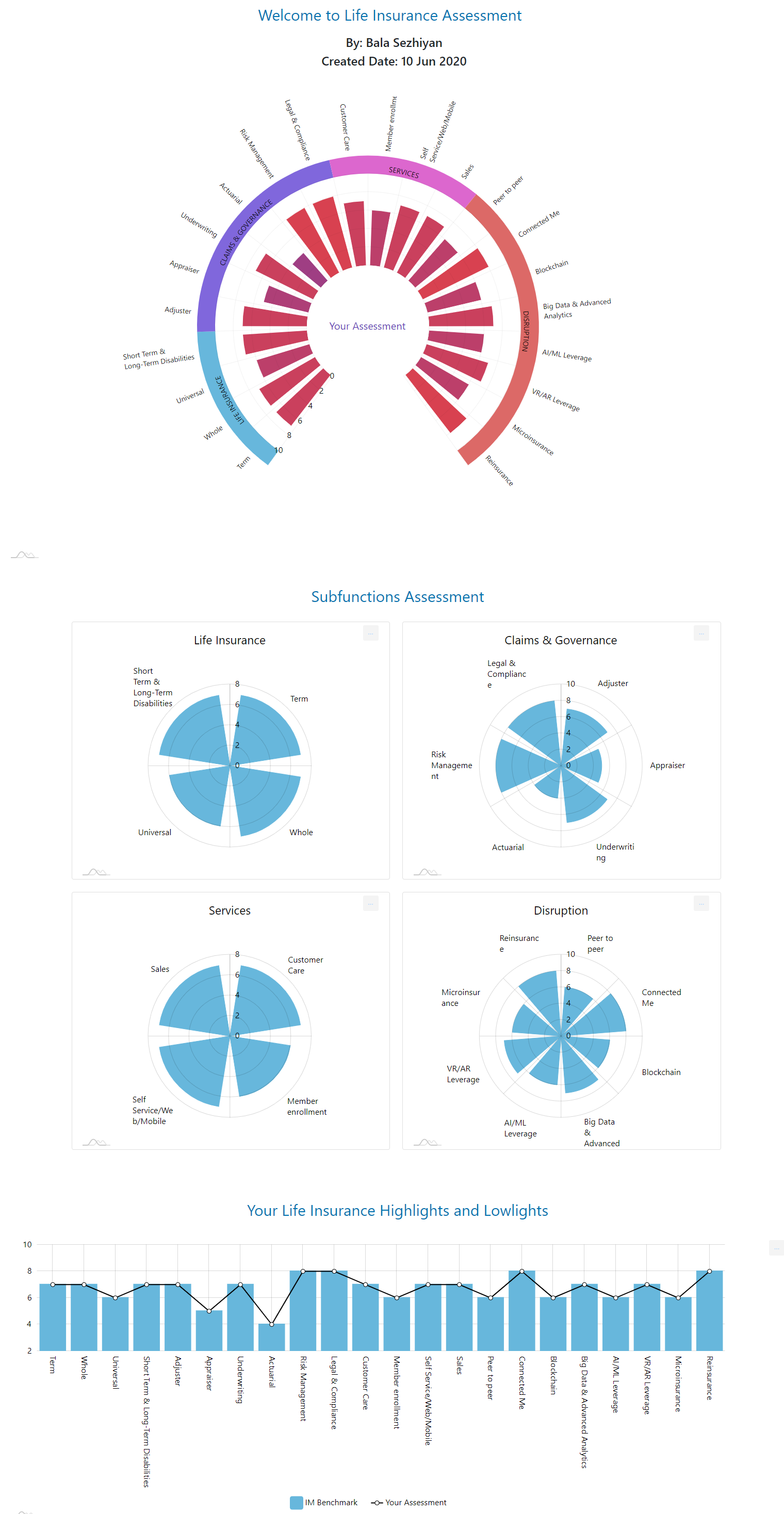

The above exercise is pretty quick. It can be completed by any stakeholder in about 15-30 minutes and results in a visual way to represent where one’s Innovation Program technology sits in comparison to industry benchmarks. Additionally, it can be completed by multiple individuals within an organization to calibrate a mutual understanding between their collective Innovation Program departments and/or other internal stakeholders. Maturity (scale of 1 to 10) is explained below.

-

- Just realized – Process not in place, however, there is a realization of the need.

- Initial (chaotic, ad hoc, individual heroics) – the starting point for use of a new or undocumented repeat process.

- Repeatable – the process is at least documented sufficiently such that repeating the same steps may be attempted.

- Defined – the process is defined/confirmed as a standard business process.

- Capable – the process is quantitatively managed in accordance with agreed-upon metrics.

- Efficient – process management includes deliberate process optimization/improvement.

- Innovator – Started challenging status-quo and incremental innovation started at the edges.

- Disruptor – The tangible impact of the innovation has been proven, started institutionalizing the sustainable.

- Market leader – You are nailing it.

- World-class – The true north of all.

And the final Report is:

** Blue bar represents Innovation Minds benchmark baselined from 25+ companies we worked with, and the black line represents where you may stand.